Taiwan offers tourists and visitors a 5% VAT refund on goods over NT$2,000. But they’ll charge you a 20% administrative charge. Read this guide to learn how to claim your refund.

As someone who has lived in Taiwan for over six years, I want to help travelers and digital nomads get the most out of their trips. Part of that starts with getting a small reimbursement on certain items.

Table of Contents

Summary of Taiwan’s VAT Refund

| Tax Rate | 5% |

| Administration Charge | 20% |

| Receivable Refund | * Price on receipt / (1.05 x 0.05) |

| Minimum Purchase Amount | NT$2,000 at one TRS-labeled store |

| How to Receive Refund | ** Cash or your credit card |

* You will round to the nearest whole number.

** If you opt to receive cash, you’ll need to go to banks or cash counters at airports or seaports to claim your refund.

Some sources will claim that there’s also a 14% handling fee. This is outdated information.

What Is Taiwan’s Tourist Tax Refund?

Any tourist staying in Taiwan for under 183 days can claim a 5% value-added tax (VAT) refund on large-ticket items. So long as they cost more than NT$2,000 ($62.75).

Goods bought from Shin Kong Mitsukoshi must be more than NT$3,000 ($95).

I don’t want to risk presenting the wrong information. So here’s a screenshot of how Taiwan calculates its tax refund:

Source: taxrefund.net.tw

And you can’t claim accommodation bookings or meals under the tax refund. Unfortunate.

To get this refund, you’ll need to meet certain requirements and claim it at certain places. I’ll emphasize this further in a second.

Requirements to Claim a Refund

Documents you’ll need for Taiwan’s tourist tax refund include:

- Travel documents: Plane tickets, etc.

- Entry stamp: For those who entered without a visa

- Passport of your home country

- ROC (Taiwan) passport is applicable ONLY if you don’t have a personal ID number in Taiwan

- Visa: If that’s how you entered Taiwan

- Application form for VAT refunds

- Your receipt

Let’s cover eligibility.

Eligibility Requirements

To participate in the Republic of China’s (Taiwan) VAT refund, you’ll need to meet these requirements:

- Stay in Taiwan for no more than 183 days in total

- Purchases of at least NT$2,000 ($62.75)

- Buy from stores with the ‘Taiwan Tax Refund’ label

- You must claim refund from shops within 90 days of your purchase

Goods that aren’t refundable under Taiwan’s VAT refund system include:

- Duty-free items

- Hotel stays

- Restaurant bills

- Things that go against the rules of items you can have in your airplane cabin or on board.

- Unpacked items

- Unaccompanied items

Some items that you can’t bring on ships and planes include [1]:

| Flammables | Aerosols | Corrosives |

| Magnetic materials | Toxic substances | Explosives |

| Briefcases w/ alarms | Oxidizers | Radioactive substances |

Look into what’s banned by the Air Transport Association when you’re reading this post. What they allow can change at any time. Here’s a link from 2024 (PDF link).

Claiming refunds anywhere other than ports will have limits. Check them out before going on a spending spree.

VAT Refund Limits

If you’re claiming your refund anywhere else than an airport, you’ll encounter the following refund limits:

| Store | Limit (NT$) | * Limit (USD) |

|---|---|---|

| Single Store | >NT$48,000 | >$1,506 |

| Multiple Visits | >NT$240,000 | >$7,530 |

| Single Shopping Center | >NT$120,000 | >$3,765 |

* Since currency exchange rates change all the time, I can’t guarantee this number is correct. Check the current exchange rate.

You’ll also have a NT$48,000 limit if you claim a refund at the Taipei Main Station Airport MRT (A1) service counter.

Purchases exceeding these limits will require you to use an E-VAT refund or VAT service centers at ports.

Where To Find Stores Authorized Stores

The list of supported stores would require me to write a novel. Taiwan’s tax refund website lists every authorized store.

Filter supported shops by:

- Category of items: e.g., clothing

- City

- Keyword: Type a store’s name

- Nearby stores: Uses your device’s location to find nearby stores

Once you find a store in the search area, you’ll see the store’s name, address, phone number, and operating hours.

Each store or department store will have VAT claim counters in varying spots. Check out each mall’s map and find the counter.

Ensure the store has this TRS logo:

That logo means the store or counter can deal with VAT refunds.

Once you claim your tax-free form from the shop, you must present it when leaving a port or airport. I’ll explain how to do this later.

You 99.99% likely can’t claim tourist tax refunds from mom-and-pop shops selling souvenirs. But if you’re looking for gift ideas to buy for people back home, I recommend checking out a guide I wrote.

Where To Claim

The following sections will cover establishments and businesses where you can immediately claim your tax refund.

1. Shopping Centers

- When to Apply: On the purchase date.

- Time Limits: Within 90 days from purchase date

- Within 20 days before departure

- How to Claim:

- Ask the store clerk for the Tax Refund Claim Form

- Present your passport

* Tourists must leave Taiwan within 20 days of submitting their tax refund application. If they don’t depart within this period, they won’t be eligible for the refund.

Some of the following shopping centers in Taipei City will allow you to immediately claim your VAT refund:

| Mall Brand & Branch | Floor for Tax Refund | Address |

|---|---|---|

| * Shin Kong Mitsukoshi A4 | 3 | 110, Taipei City, Xinyi District, Songgao Rd, 19號B2 |

| Far Eastern SOGO Fuxing | 1 | No. 300, Section 3, Zhongxiao E Rd, Da’an District, Taipei City, 106 |

| * Shin Kong Mitsukoshi A8 | 3 | No. 12, Songgao Rd, Xinyi District, Taipei City, 110 |

| Far Eastern SOGO Zhongxiao | B2 | No. 45號, Section 4, Zhongxiao E Rd, Da’an District, Taipei City, 106 |

| * Shin Kong Mitsukoshi A9 | B1 | No. 9, Songshou Rd, Xinyi District, Taipei City, 110 |

| Far Eastern SOGO Dunhua | 4 | 106, Taipei City, Da’an District, 敦化南路1段246號 |

| * Shin Kong Mitsukoshi A11 | 3 | No. 11, Songshou Rd, Xinyi District, Taipei City, 110 |

| Far Eastern SOGO Tianmu | 1 | 111, Taipei City, Shilin District, 中山北路六段77號 |

| Taipei 101 | 1 | No. 45 號, City Hall Rd, Xinyi District, Taipei City, 110 |

* All the Shin Kong Mitsukoshi stores will charge a 20% processing fee.

These offer private VAT tax refund services, often at a higher price. And the counters will have this logo:

Source: Taichung.travel

2. Airports

- When to Apply: Before you check in your luggage

- Time Limits: Within 90 days from purchase date.

To deal with your tax refund at the airport, you’ll need to follow these steps:

- Before checking in your luggage, visit an E-VAT Refund Machine or a VAT Refund Service Counter

- Present the following to the staff or machine:

- Purchased goods

- Tax Refund Form

- * The receipt (or digital invoice) for your goods

- Personal and travel documents: passport, visa, etc

- Choose a way to receive your reimbursement: check, credit card, cash, or debit card

- Obtain the Tax Refund Assessment Certificate for Eligible Goods Purchased by Foreign Travelers

- Get on your flight and go home

* If you use an e-invoice app, the shop assistant will scan your phone and send the receipt to the cloud. You must open the receipt app and show them the cloud receipt.

If the VAT Refund Service Counter isn’t open, you’ll need to find an E-VAT Refund Machine. I’ll cover ports and airports where you can find these machines later.

You’ll need to visit a Cash Counter if you receive your refund as cash. You’ll receive New Taiwan Dollars (NT$). So you’ll need to visit a currency exchange counter to get your home’s currency.

Want to visit Taiwan in the future? You may want to consider saving this cash for later.

Getting the refund as a check will require the staff to mail the check to your home. Receiving a refund through a bank or credit card doesn’t require you to travel anywhere.

Here’s a video to “help” illustrate my point:

Here’s Where to Find VAT Refund Counters Every Airport

1. Taoyuan International Airport – First floor, Terminal 1, Departure Hall

For some reason, the map’s in Chinese. But here’s a link to Taoyuan Airport’s map in case they update it.

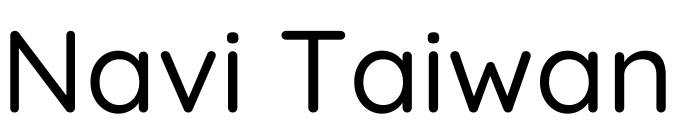

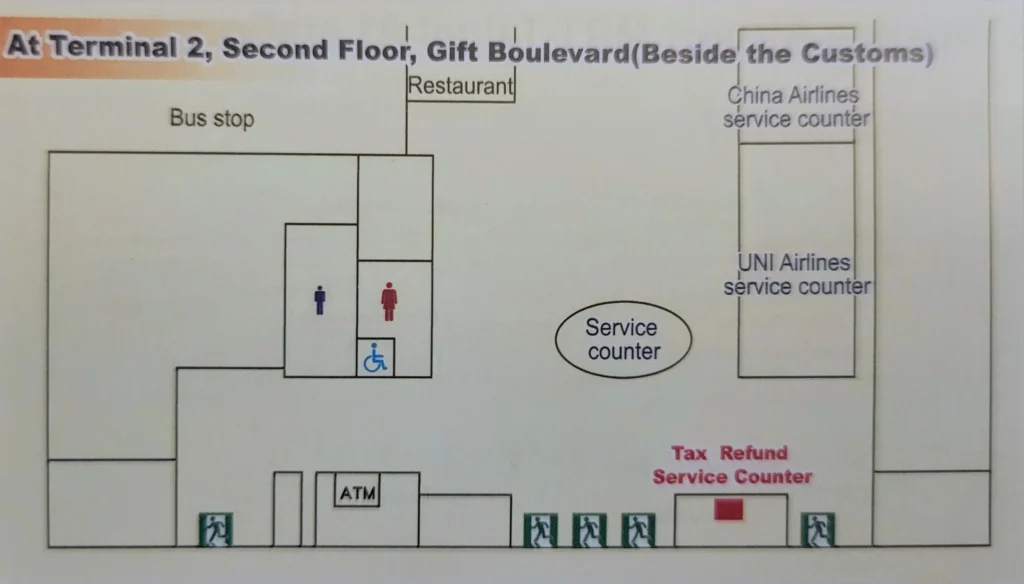

2. Taoyuan International Airport – Second floor, Terminal 2, Gift Boulevard

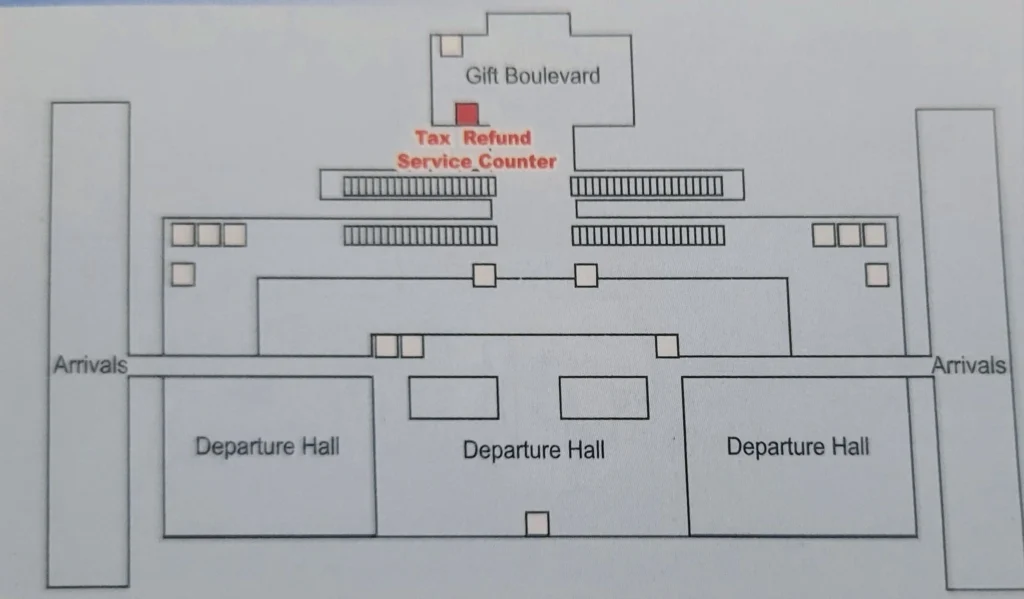

3. Taoyuan Airport MRT (in Taipei A1 Station)

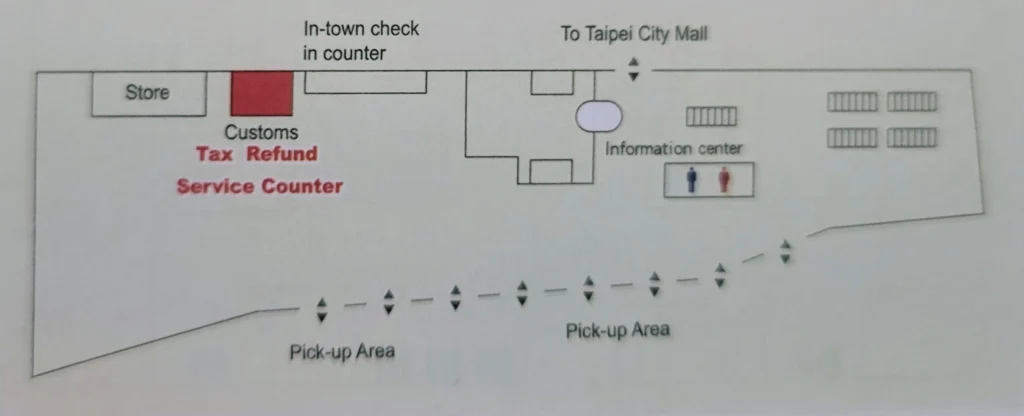

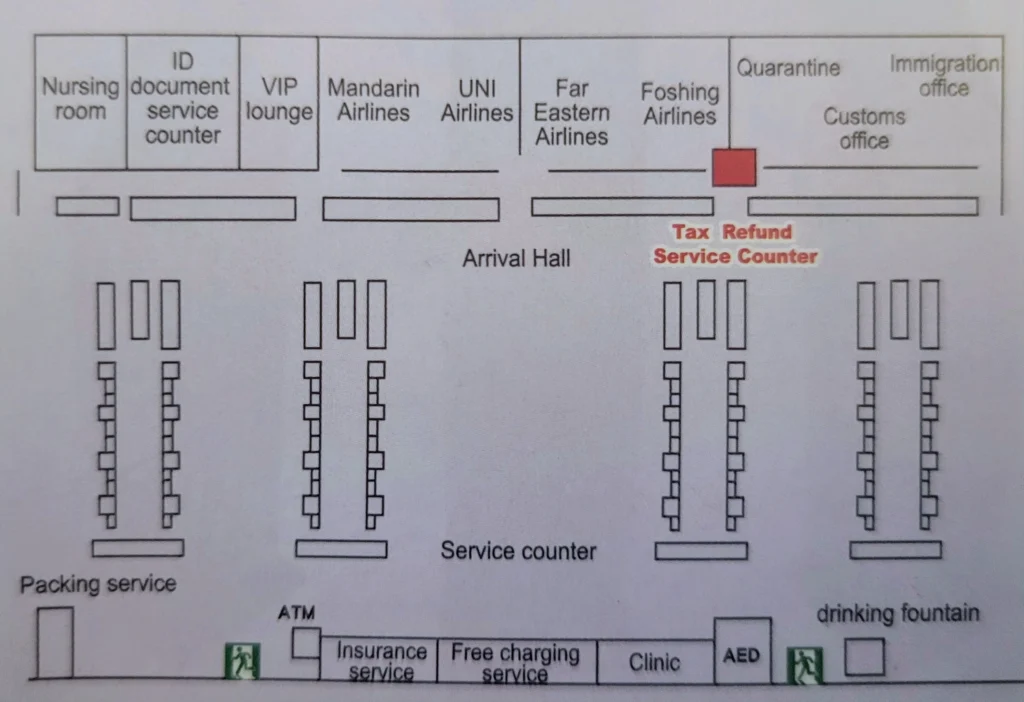

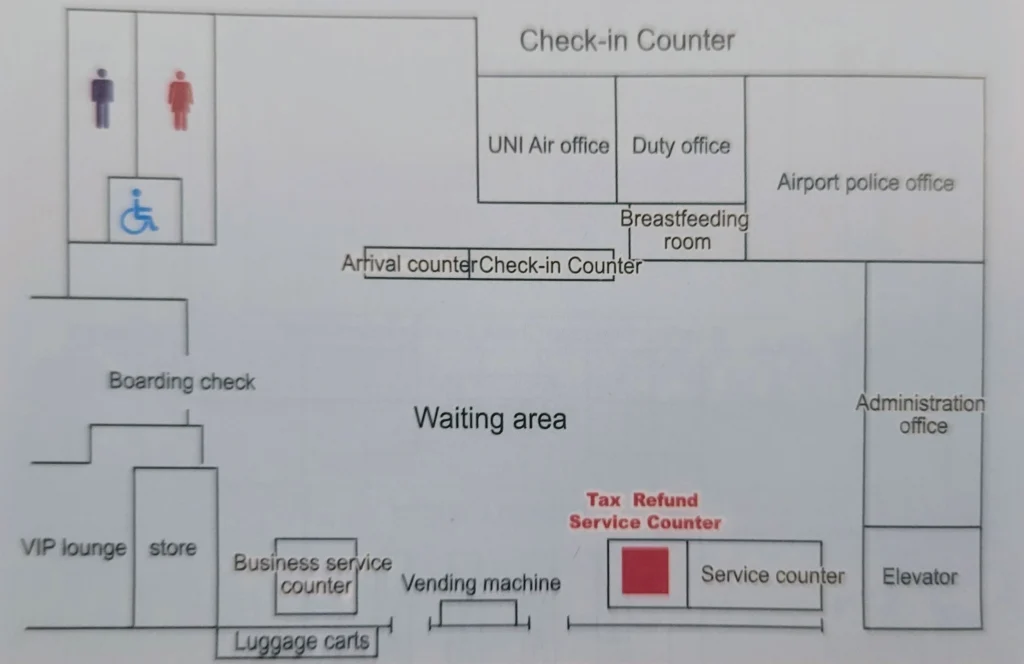

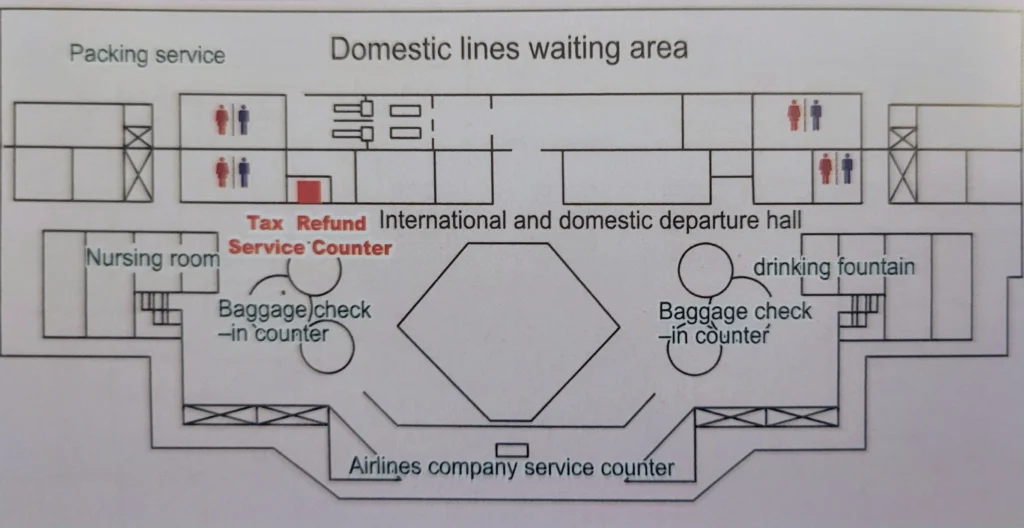

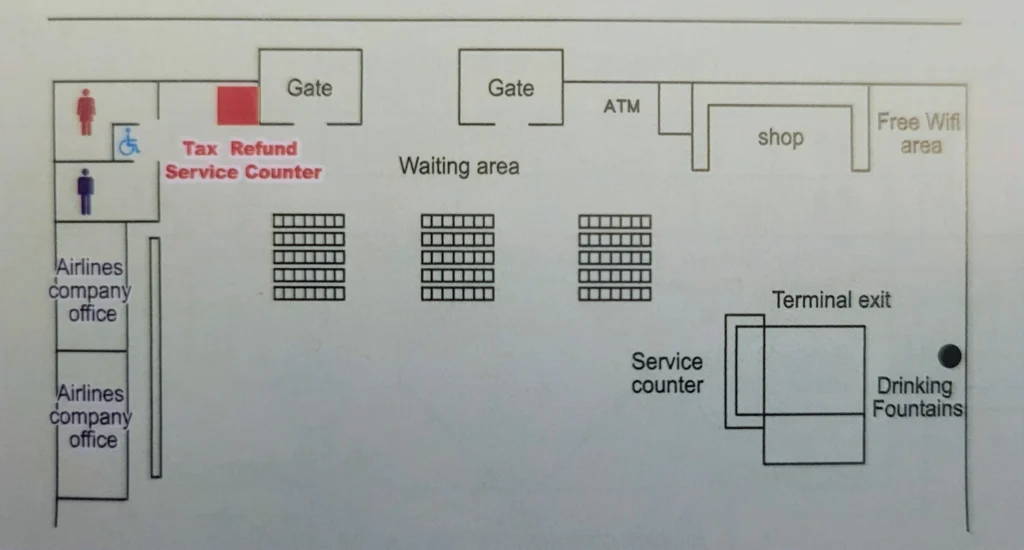

4. Songshan Airport – First floor, Terminal 1

The VAT refund counter is the only text that’s in Chinese. Here’s the page where I sourced this image.

5. Kaohsiung International Airport – Third floor, Departure Lobby

6. Magong Airport – First floor, Lobby

7. Chiayi Airport – First floor, external waiting room

8. Hualien Airport – Second floor, Departure area

9. Taitung Airport – First floor

10. Tainan Airport – Terminal 2, Gift Boulevard

3. Seaports

- When to Apply: Before you check in your luggage

- Time Limits: Within 90 days from purchase date.

Here are airports and ship ports throughout Taiwan where you can find E-VAT kiosk machines

1. Airports:

| Airport | Location |

|---|---|

| Taipei Songshan Airport | Terminal 1, Floor 1 |

| Taoyuan International Airport (Terminal 1) | 1st floor, departure hall |

| Taoyuan International Airport (Terminal 2) | 2nd floor, Gift Boulevard (By Customs) |

| Taipei Main Station | Next to the in-town check-in counter at Level B1 |

| Taichung Airport | 1st floor beside customs |

| Chiayi Airport | 1st floor beside service counter |

| Tainan Airport | 1st floor by customs |

| Kaohsiung International Airport | 3rd floor departure hall |

| Hualien Airport | 2nd floor |

| Taitung Airport | 1st floor by the restroom |

| Magong Airport (Penghu) | 1st floor by the FAT counter |

2: Ship ports:

| Seaport | Location |

|---|---|

| Port of Shuitou | 2nd floor in the tourist service center |

| Port of Magong | 2nd floor in the tourist service center |

| Suao Port | Suao Section, Hualien Branch, Keelung Customs Office |

| Port of Hualien | Inside tourist center |

| Port of Kaohsiung | By tourist center |

| * Port of Kaohsiung (Kaohsiung Custom Administration) | Service counter |

| Port of An-Ping | By tourist center |

| Port of Taichung (Dock 8A) | On the dock |

| Port of Taichung (Dock 19A) | 1st floor, Tourists Service Center |

| Port of Taichung (Dock 30A) | On the dock |

| Port of Taipei | 1st floor by passenger waiting area |

| Keelung Harbor Terminal | 2nd floor seating area |

| West Passenger Terminal | 2nd floor seating area |

| Fuao Harbor | 1st floor Transporting building |

* Only available to foreign fishing crews.

Actually Useful Tips for Claiming Refunds

Consider these tips if you want to claim a VAT refund:

- Download the Taiwan Tax Refund app: The Ministry of Finance’s app allows you to calculate your refund, search nearby TRS-labeled stores, and to make claim reservations.

- Check-in your luggage AFTER claiming your tax refund to avoid issues.

- If you miss your scheduled flight after a refund, you’ll need to clear customs through the “Good to Declaration” (Red Line); this will prevent fines.

- If the tax refund system were to shut down after you claimed your refund, you may need to claim it again at a tax refund service counter at the airport.

I’m sure I missed something in this guide. If I did, I’ll come back and make adjustments.